Latest News

DP World Industrial Action/Cyber Incident

DP world have issued a statement advising the industrial action has been extended until the 4th December.

In combination with the recent cyber-attack, the ports are experiencing processing delays of up to 7-14 days effecting both imports and exports. These delays are expected to worsen coming into the Christmas period.

Full Article >

Seasonal measures for Brown Marmorated Stink Bug (BMSB)

The Department of Agriculture, Fisheries and Forestry have finalised the seasonal measures for the 2023-24 BMSB season. Measures will apply to targeted goods manufactured in or shipped from target risk countries, that have been shipped between 1 September 2023 and 30 April 2024 (inclusive), and to vessels that berth, load, or tranship from target risk countries within the same period.

The measures remain consistent with the 2022-23 BMSB risk season with the addition of Uzbekistan as a target risk country.

Break bulk, open top containers, and flat rack containers with high-risk goods from high risk countries will still require mandatory offshore treatment with no available avenues to treat onshore.

In addition, the department continues to review the changing risk status of BMSB and will also be undertaking random onshore inspections on goods from other emerging risk countries to verify pest absence in goods.

The shipped on board date, as indicated on the Ocean Bill of Lading, is the date used to determine when goods have been shipped. “Gate in” dates and times will not be accepted to determine when goods are shipped.

Important to note, goods must be treated by an approved treatment provider.

- If your goods are classed as target high risk, they will require mandatory treatment.

- If your goods are classed as target risk, they will be subject to random inspection.

- If your goods are not found in either category, they are not subject to BMSB measures, however, will be subject to the measures if packed with target high risk or risk goods.

Shortages of Equipment & Space Issues

We are still seeing congestion delays throughout USA, Europe, and Asia (Especially Los Angeles & Japan), along with transhipment ports Singapore & Port Klang.

As this is an industry-wide issue with many ports around the World affected, we seek your understanding as we work relentlessly to meet your shipping needs.

Please ensure to give plenty of notice for all new bookings as pre-booking space in advance is vital, especially coming into peak season.

Brown Marmorated Stink Bug (BMSB) Season - 1st September 2022

For the 2022-23 BMSB risk season, BMSB seasonal measures will apply to targeted goods manufactured and shipped from target risk countries, that have been shipped between 1 September 2022 and 30 April 2023 (inclusive), and to vessels that berth, load, or tranship from target risk countries within the same period.

Important to note, goods must be treated by an approved treatment provider.

In addition, the department continues to review the changing risk status of BMSB and will also be undertaking random onshore inspections on goods from other emerging risk countries to verify pest absence in goods.

Break bulk, open top containers, and flat rack containers with high-risk goods from high risk countries will still require mandatory offshore treatment with no available avenues to treat onshore.

What's New:

- Emerging risk countries - China and UK only subject to random onshore intervention

- Chapters 94 and 95 will be subject to random inspections for emerging risk countries

- 120 hours policy been amended for goods that have been rolled (with evidence)

CLICK HERE for list of 'Target Risk Countries'

CLICK HERE for list of 'Target High Risk Goods'

Marine Insurance

Do you have Marine Insurance cover?

Control Global Logistics can arrange Marine Insurance on a per shipment basis to fit your individual requirements at competitive pricing.

Please contact our lovely sales team for a quote today – [email protected]

Full Article >Congestion Delays

We are still seeing congestion delays throughout Europe and USA, along with some Asian ports, including transhipment ports Singapore and Port Klang.

As this is an industry-wide issue with many ports affected, we seek your understanding as we work relentlessly to meet your shipping needs.

Please also give plenty of notice for new bookings as pre-booking space in advance is vital.

Wharf increase to Timeslots/De-Hire/Infrastructure Levies

Patricks Terminal have confirmed they are again increasing timeslot/infrastructure levies from 1st March 2022.

The total Increase to timeslot/infrastructure levy for FCL Import/Exports effective 10th March 2021:

- Sydney: $365 per container

- Melbourne: $350 per container

- Brisbane: $350 per container

- Fremantle: $300 per container

- Adelaide: $300 per container

Therefore, LCL infrastructure has also increased to $17.50w/m for all ports.

Fuel Surcharge increase

As everyone is aware fuel has significantly increased recently and transport can no longer absorb this latest hike.

We unfortunately must pass on this increase effective 10th March.

Addition of China to the Brown Marmorated Stink Bug (BMSB) Emerging Risk Country list

The Department of Agriculture, Water and the Environment has recently issued Import Industry Advice Notice, advising of the addition of China to the Brown Marmorated Stink Bug (BMSB) Emerging Risk Country list.

What has changed?

As a result of detections of live BMSB in some containerised commodities originating in China, the department will be adding China as an emerging risk country for the remainder of the 2021-22 BMSB season.

The increased random inspection activities will apply to the following goods:

- Goods manufactured in, or shipped from China and,

- FCL / FCX containers – for goods shipped in sealed 6 hard sided containers and,

- Goods tariffed as Chapters 39, 68, 69, 70, 73, 84, 85 and 89.

LCL / FAK containers and break bulk goods (including those shipped on flat rack or in open top containers) are out of scope for increased inspection activities.

In scope containers, as identified above, will be selected at random and will be directed for an ‘Inspection – Seals Intact Inspection’.

Mis-declared Import Container Weights

Please be advised a Weight Amendment Fee for Import Containers - Weigh and Adjustment charge of AUD295 per container plus GST will apply to all containers determined by the Pondus Stand to have a weight variance of greater than +/- one metric tonne within the documented weight.

It is the shipper’s responsibility to ensure that the correct of weight of an import container is documented prior to it being discharged and subsequently collected.

The Weight Amendment Fee will not apply to importers and exporters who accurately declare container weights in compliance with the SOLAS regime.

Australia – United Kingdom Free Trade Agreement

The Australia-United Kingdom Free Trade Agreement (Australia-UK FTA), signed virtually on 17 December 2021, is a gold standard trade agreement that represents a once in a generation deal for Australia and an historic moment in our relationship with the UK.

The signing of the AUKFTA does not mean it has commenced. In Australia, it still needs to go through the Parliamentary process, including approval by the Joint Standing Committee on Treaties and the passage of legislation. A similar process will be required in the UK.. In reality, entry into force and implementation of the AUKFTA may not occur until late in the second half of 2022.

For more information – please CLICK HERE

Marine Insurance

Do you have Marine Insurance cover?

Control Global Logistics can arrange Marine Insurance on a per shipment basis to fit your individual requirements at competitive pricing.

Please contact our lovely sales team for a quote today – [email protected]

Full Article >Seafreight

Shortages of Equipment & Space Issues

We are still seeing shortages of equipment and space issues throughout NZ, USA, Europe, and Asia (Especially Los Angeles, Germany, Turkey, Thailand & Japan, with the current wait on bookings around 1 month).

To add, Germany & mid-west USA are also experiencing delays on truck/rail services.

As this is an industry-wide issue with many ports around the World affected, we seek your understanding as we work relentlessly to meet your shipping needs.

Please give plenty of notice for all new bookings as pre-booking space in advance is vital

Brown Marmorated Stink Bug Season - 1st September 2021

For the 2021-22 BMSB risk season, BMSB seasonal measures will apply to targeted goods manufactured and shipped from target risk countries, that have been shipped between 1 September 2021 and 30 April 2022 (inclusive), and to vessels that berth, load, or tranship from target risk countries within the same period.

Important to note, goods must be treated by an approved treatment provider.

In addition, the department continues to review the changing risk status of BMSB and will also be undertaking random onshore inspections on goods from other emerging risk countries to verify pest absence in goods.

BREAKBULK OPEN TOP CONTATINERS FLAT RACKS

Break bulk, Open top containers, or on flat rack containers of High-Risk goods from High Risk countries will still require mandatory offshore treatment with no available avenues to treat onshore. From the 1st September 2021 to 30th November 2021, a post treatment window of 120 hours applies. Your goods must be loaded onto a vessel for export to Australia within 120 hours after treatment has been carried out.

What's New

23 July 2021 – addition of Poland as a target risk country

23 July 2021 - Emerging risk countries identified as Belarus, Malta, Sweden, United Kingdom and Chile

Please CLICK HERE for a list of target risk countries, target high risk goods and high risk goods

Please CLICK HERE for a list of the approved treatment providers

Full Article >

Seafreight

Shortages of Equipment & Space Issues

We are still seeing shortages of equipment and space issues throughout NZ, USA, Europe, and Asia (Especially Los Angeles, Germany, Turkey, Thailand & Japan, with the current wait on bookings around 1 month)

To add, Germany & mid-west USA are also experiencing delays on truck/rail services.

As this is an industry-wide issue with many ports around the World affected, we seek your understanding as we work relentlessly to meet your shipping needs.

Please give plenty of notice for all new bookings as pre-booking space in advance is vital

Wharf increase to Timeslots/De-Hire/Infrastructure Levies

DP World Logistics Park have confirmed that they are introducing a Peak Traffic Management Surcharge from 1st May 2021.

The Justification provided to the industry for this further increase was DP World have identified peak trucking activities around our facilities that are contributing to long trucking queues, which are a hazard to all other traffic users.

DP World has also announced an increase to the Terminal Access Charge (previously infrastructure levy) for every imported and exported container from 1st May 2021

Increase to timeslot/infrastructure levy for FCL Imports/Exports:

- Sydney: $310 per container

- Melbourne: $275 per container

- Brisbane: $275 per container

- Fremantle: $200 per container

- Adelaide: $200 per container

Imported Foods Notice - Changes to mandatory allergen labelling

Food Importers - Please note there are changes to mandatory allergen labelling.

Please CLICK HERE for more information

Khapra Beetle

In response to recent interceptions of khapra beetle on imported cargo and containers into Australia, The Australian Department of Agriculture, Water and the Environment has announced mandatory offshore treatment requirements for target risk sea containers with effect from 12th April 2021.

The Khapra beetle is a serious agricultural pest that poses a major threat to the Australian grain industry, as Australia is recognised globally as free of khapra beetle (Trogoderma granarium), which is a serious grain and seed storage pest in overseas countries (see below link for target risk countries). This exotic pest comes in second on Australia’s most unwanted plant pest list.

The most likely pathway for khapra beetles to enter Australia is with the movement of contaminated goods, including grains, food stuffs, personal effects and as a hitchhiker in shipping containers and a wide range of cargo (plastic beads, nuts and bolts, timber doors).

Offshore fumigation will be applicable when:

- High-risk plant products are packed into the sea container in a khapra beetle target risk country.

- Other goods are packed into the sea container in a khapra beetle target risk country and destined to a rural grain growing area of Australia.

For a list of high risk plant products, please CLICK HERE

For a list of high risk countries, please CLICK HERE

For more information, please CLICK HERE

Full Article >

Important Notice

Shortages of Equipment - Schedule Disruption/Delays

We are still seeing shortages of equipment and space issues throughout NZ, USA, Europe, and Asia (Especially Los Angeles, UK, Germany, Turkey, Thailand & Japan, with the current wait on bookings around 1 month)

To add, Germany & mid-west USA are also experiencing bad weather/heavy snow which in turn is causing delays on truck/rail services.

With most transhipment ports in Asia (eg: Singapore/Port Klang) we are seeing heavy delays in connecting vessels into Australia with containers being rolled regularly.

As this is an industry-wide issue with many ports around the World affected, we seek your understanding as we work relentlessly to meet your shipping needs.

Please give plenty of notice for all new bookings as pre-booking space in advance is vital

Wharf increase to Timeslots/De-Hire/Infrastructure Levies

Increase to timeslot/infrastructure levy for FCL Imports/Exports

- Sydney: $275 per container

- Melbourne: $275 per container

- Brisbane: $275 per container

- Fremantle: $200 per container

- Adelaide: $200 per container

Sideloader Levy Increase

Increase to Sydney Sideloader levy for FCL Import/Exports that utilise a sideloader trucks for transport

Brisbane has also introduced this same levy

- Sydney Sideloader Levy: $95 per container

- Brisbane Sideloader Levy: $85 per container

Weight Adjustment Fee

The terminals have introduced a new charge, a Weight Adjustment Fee, for import containers which are discovered to have a weight outside a variance of +/- 1 tonne from the declared weight.

The Weight Adjustment Fee will be charged at $295 per container

International Terminal Fee

Airlines have announced an increase to their International Terminal Fee (ITF)

New cost: $0.65/kg or minimum $95

Full Article >Seafreight

2020-2021 Brown marmorated stink bug (BMSB) seasonal measure

As per our previous newsletter, BMSB season is now underway.

The Season will be in effect for goods shipped from September 1, 2020 that arrive in Australian territory prior 31 May 2021 (inclusive)

In order to provide clarity at season's end, it is important to note that goods must be treated by an approved provider if exported between 1 September 2020 and 30 April 2021 inclusive .

Any target high risk or target risk goods which are manufactured in or shipped from the target risk countries will be subject to the BMSB seasonal measures. This includes vessels that tranships from target risk countries.

IMPORTANT NOTE:

In addition, the department will also be undertaking random onshore inspections on goods from other emerging risk countries to verify pest absence in goods.

The department is also monitoring other countries through a lower rate of random inspections. These include all remaining European countries, Japan, China, Korea, Taiwan, Argentina and Uruguay.

Please CLICK HERE for a list of target risk countries, target high risk goods and high risk goods

Please CLICK HERE for a list of approved offshore treatment providers

Wharf increase to Infrastructure Levy

Increase to timeslot/infrastructure levy for FCL Imports/Exports

- Sydney: $245 per container

- Melbourne: $245 per container

- Brisbane: $245 per container

- Fremantle: $200 per container

- Adelaide: $200 per container

Urgent actions to address Khapra Beetle

Increase to The Department of Agriculture, Water and the Environment have advised us they are implementing urgent actions to address the risk of khapra beetle from entering Australia.

The measures are to be introduced in phases, with Phase 1 taking effect 3rd September 2020.

Phase 1 will place restrictions on importing unaccompanied personal effects (UPE’s) and low value sea or air shipments lodged via the SAC (Self-Assessed Clearance) system.

It is worth noting that the measures are only in place against the listed unprocessed materials. Goods that are commercially prepared and packaged and trade samples are exempt from the measures.

For the full details on the measures and the affected products, please CLICK HERE

Importing of any Timber Articles

For any shipping of timber articles, it may be accepted by Australian Biosecurity as being "Highly Manufactured" and low risk.

If so, a valid Manufacturers Declaration may be all that is required for Clearance (Please confirm with our CGL Customs team before export)

Note: MDF/Particle Board items MUST NOT contain ANY Solid Timber items – eg. Support/reinforcing pieces etc

Please contact us if you need a Manufactures Declaration template or if you have any questions/queries on if your product falls in the highly manufactured list or not

Illegal Logging Reminder

The Australia’s illegal logging laws ‘The Illegal Logging Prohibition Act 2012’ (the Act) seeks to reduce the harmful environmental, social and economic impacts of illegal logging by restricting the importation and sale of illegally logged timber products in Australia. The Act makes it a criminal offence to knowingly, recklessly or intentionally import illegally logged timber and/or timber products into Australia.

Please ensure that you know where your timber is coming from and having effective due diligence systems that are comprehensive and up to date.

Please CLICK HERE for a range of information to help you meet your due diligence obligations on illegal logging

Changes to import rules for equipment containing Hydrofluorocarbons (HCFC) depleting substances

From Jan 1 2020 the rules for Importing Goods with HCFC changed and goods will need to have an Import Permit – No Exceptions

If you have an enquiry about any Refrigeration Machines, Parts for machines or gas, please refer to the Dept of the Environment, to ensure your imports are compliant with current legislation.

At the time of import, we will need Manufacturer Technical Sheets or the website where we can obtain this information – confirming Equipment’s Technical Specifications including the Gas Type.

Written Approval or Permit (Confirming Model No etc) will be required to Import these goods.

The Changes are:

- From 1 January 2020 importing all types of HCFC equipment (including, for example, HCFC aerosols and HCFC fire protection equipment) will be banned, except in certain circumstances. This includes all equipment that uses HCFCs, even if it does not have gas in it at the time of import.

- From 1 January 2020, an equipment licence may be granted for import of HCFC equipment only in limited circumstances.

- From 1 January 2020 low volume imports of HCFC equipment without a licence will no longer be allowed.

Important Notice

Sydney Port Congestion - Schedule Disruption/Delays - Update # 2

As per previous advice around Sydney Port Congestion, please find below update applicable to both import/export cargo:

- Most carriers have now followed suit with the Port Congestion Surcharge of USD300/TEU (Hamburg Sud highest at USD350/TEU) and will either be charged at destination or applied to the freight rate from 14/9/20 until further notice

- LCL cargo Port Congestion Surcharge = USD15.00w/m or minimum USD15.00

- Some carriers have announced a temporary stoppage of accepting bookings to Sydney (Maersk/OOCL/Hamburg Sud)

- Some carriers will continue with port omissions and port rotations as necessary

Patricks Terminal:

"Currently, our Sydney Terminal is currently 12-14 days behind schedule, and it is forecast that the delays will increase due to the ongoing Protected Industrial Action. It is estimated that there is a backlog 35,000 containers waiting to be loaded or discharged at Patrick Terminals – Sydney. Patrick Terminals in Brisbane and Melbourne also have berthing delays in excess of five days."

DP World:

Still heavy backlog/congestion, though we have received advice from DP World Australia that the Maritime Union of Australia (MUA) will not be taking industrial action of any kind at their Port Botany terminal before 1 November 2020.

We will continue to keep our clients updated on their bookings, though if you have any queries or concerns in the meantime, please contact us.

Full Article >Important Notice

Sydney Port - Schedule Disruption/Delays - Port Congestion Surcharge

Please find the latest updates directly from carriers around Sydney Port Congestion, Weather delays and continued Industrial Action.

MSC

MSC Mediterranean Shipping Company announces that due to congestion in the port of Sydney, caused by industrial actions which are impacting Sydney’s terminals productivity, a Congestion Surcharge (CGS) will apply to maintain the service at the required level.

A Congestion Surcharge of USD 300 per TEU will be introduced with the following validity:

- Import cargo: for vessel arrival on the 14 September and onward

- Export cargo: from commercial date 14 September and onward

- For Import cargo from U.S: from cargo possession on 8 October

- For Export cargo to U.S.: from cargo possession on 8 October

ANL

ANL and CMA CGM announce a Port Congestion Surcharge also (both standard and reefer containers) will be introduced for all containers arriving/departing Sydney.

A Congestion Surcharge of USD 285 per TEU will be introduced with the following validity:

- Export cargo for all vessels (non USA trades) departing Sydney on or after 17th September

- Import cargo for all vessels (non USA trades) arriving Sydney on or after 17th September

- Export cargo for all vessels (USA trades) departing Sydney on or after 10th October

- Imports for all cargo received (USA trades) on or after 10th October

Terminal Situation – Sydney

DPW

- Based on the outcome of a Protected Action Ballot Order (PABO) last week, the Maritime Union of Australia (MUA) can now undertake work bans and stoppages within 5 working days of notice provided to DPW.

- At this time, however, the MUA have not tendered notice to DPW.

- As such, no change where Protected Industrial Action (PIA) remains lifted for Fremantle, Brisbane and Melbourne, but where work restrictions still apply for Sydney, and berthing protocols continue until the PIA has been lifted.

- Average delays in Sydney DPW now stand at 24 to 72 hours

- Congestion due to the number of off-window vessels, impacting the berthing line-up.

- Expected recovery now estimated by week 40, but remaining under close review.

Patrick

- Delays in Sydney now averaging between 12-14 days for the current week

- The situation may unfortunately deteriorate further depending on the impact of PIA.

- Patrick Terminal have released details of the Protected Action plans that were received on 3rd September that will see work stoppages of up to 24 hours on multiple days over the next 2 weeks across Brisbane, Sydney, Melbourne, and Fremantle Patrick Terminals. Regret these work stoppages and those expected at other terminal operator locations will both disrupt schedule integrity in September and have a cascading impact into October due to the delays as vessels return back to Asia.

Ongoing industrial action at terminals around Australia has created severe disruptions to shipping lines schedule integrity. The delays experienced around the Australian coast over the past month has impacted all shipping lines vessel schedules upon their return back to Asia. Subsequently this has & will cause further delays and congestion on most services departing Asia for Australia in September. Carriers will continue to use change of port rotation options around the Australian coast on their services in order to minimize delays.

Carriers will temporarily restrict bookings to Sydney on AAUS Northern Loop product (NE Asia to Australia) until 15th October 2020.

We will continue to keep you updated with any further developments.

Full Article >Cartage/Tolls

Introduction Scheme Introduction of New M5 East/M8 Toll

As you may already be aware, the NSW Government has announced that the new M5 East/M8 toll roads are now operational.

Effective immediately transport carriers have announced that these toll costs will need to be passed onto customers and will be charged each way.

To ensure cargo is delivered in a timely manner, drivers will need to take the most efficient routes.

This will relate to all modes of road transport including Air/LCL/FCL.

Full Article >

General

Australian Industrial Chemicals Introduction Scheme

As of 1 July 2020 the Australian Industrial Chemicals Introduction Scheme (AICIS) will replace NICNAS, as the national regulator of the importation and manufacture of industrial chemicals in Australia.

Anyone who imports or manufactures industrial chemicals into Australia for commercial purposes must register their business with AICIS and pay a fee as well as categorise each chemical importation or manufacture.

The ban on the use of new animal test date for ingredients solely used in cosmetics will also begin on 1 July 2020

For further information please CLICK HERE

Full Article >

The coronavirus that has emerged from China is now having an impact to the freight industry around the world.

With the extension of CNY holidays the Wuhan & Hubei governments are in lock down which may extend past February 9th.

Airline's will be ceasing their import & export operations to/from China up until March 1st, which is still subject to change at anytime.

Ocean carriers have advised of some blank sailings in early Feb, however services are still running & there are no other changes to their current export scheduling.

New restrictions are being applied to the arrival of vessels into Australia.

All vessels departing/calling via China that have a transit time of less than 14 days will be held from docking until the 14 day minimum is reached.

Eg: Sailing ex Ningbo with a 12 day transit time, will stay at sea and not dock until the 14th day.

We will continue to closely monitor with our global partners and keep our clients updated on any developments

Full Article >SEA FREIGHT

Wharf increases to Infrastructure Levies

The terminals have advised of yet another increase to their wharf infrastructure levy from 1st Jan 2020

Surcharges below:

Timeslot/Infrastructure Levy for FCL Imports/Exports: AUD200.00 – Applicable to all Import/Export cargo arriving/departing all Terminals (SYD/MEL/BNE/FRE/ADL)

Infrastructure Levy for LCL Imports/Exports: AUD16.50W/M – Applicable to all Import/Export cargo arriving/departing all Terminals (SYD/MEL/BNE/FRE/ADL)

Direct De-hire Surcharge

Carriers have introduced a direct de-hire surcharge for all containers that are required to be de-hired at the wharf instead of an empty park. Shipping lines instruct us of the de-hire location.

Below are the surcharges for Sydney/Melbourne/Brisbane - If Applicable:

$75/20' & $120/40'

Full Article >

SEA FREIGHT

International Maritime Organization (IMO) - IMO2020 Compliant

The International Maritime Organization (IMO) is an agency of the United Nations, responsible for the safety and security of the shipping industry and regulating maritime pollution of ships.

The International Convention for the prevention of pollution from ships (MARPOL) is the main International convention covering the prevention of damage to the marine environment by ships through operational or accidental causes.

IMO has set a regulation to limit Sulphur content in fuel oil to less than 0.5% effective 1 January 2020. (The current global limit for Sulphur content in fuel oil is 3.5%)

This will be implemented in efforts to drastically reduce the amount of Sulphur Oxide emitted from ships for the benefit of present and future generations.

Please be aware that there will be increased costs associated with these measures from the shipping lines to recover the costs throughout the entire shipping and supply industry.

Most shipping lines have announced that the cost increases will be effective from 1 December 2019 as they ready themselves to comply to the new legislation and be IMO2020 compliant.

The surcharge - Low Sulphur Adjustment (LSA) will be reviewed monthly by carriers.

Wharf increases to Infrastructure Levies

DP World has advised of another increase to their wharf infrastructure levy from 1st Jan 2020

Once pricing is confirmed CGL will update rates accordingly

Customs

Changes to import rules for equipment containing ozone depleting substances

Notice for importers that the rules for importing hydrochlorofluorocarbon (HCFC) Equipment are changing on 1 January 2020

- From 1 January 2020 importing all types of HCFC equipment (including, for example, HCFC aerosols and HCFC fire protection equipment) will be banned except in certain circumstances. this includes all equipment that uses HCFCs, even if it does not have gas in it at the time of import.

- From 1 January 2020, an equipment license may be granted for import of HCFC equipment only in limited circumstances.

- From 1 January 2020, low volume imports of HCFC equipment without a license will no longer be allowed.

For more information, please CLICK HERE

SEA FREIGHT

Biosecurity Imports Levy

A new Biosecurity Import Levy has been allocated in the most recent budget, scheduled to take effect 1st September 2019

As the implementation of this levy is approaching, importers will want to ensure they are prepared and have included the levy in budgeting and forecasting.

"The Levy would contribute to onshore surveillance, diagnostic, date analytics, research and adoption of new technology to help us to detect, identify and respond to exotic pest and diseases earlier and ensure we can move people and goods into Australia safely and more efficiently."

The Levy, starting 1st September 2019 will be:

- Imposed on all containerised and non-containerised cargo imported to Australia by sea, except for military equipment

- Imposed on port terminal operators for goods that are unloaded and cleared under Biosecurity Act 2015

- Cost $10.02 per incoming twenty-foot equivalent sea container and $1 per tonne for non-containerised cargo

- Cost provided is subject to change, and may include additional administration fees set by each terminal and/or service provider (and may differ per terminal and/or service provider)

For further information on the Biosecurity Imports Levy please CLICK HERE

Seasonal Measures for the 2019-20 BMSB Risk Season

The Department of Agriculture has finalised the seasonal measures for Brown Marmorated Stink Bug (BMSB) that will apply to certain goods that are manufactured in or shipped from target risk countries arriving as sea cargo.

The Measures will also apply to vessels that berth at, load or tranship in target risk countries and will apply to goods and vessels that voyage between 1st September 2019 and 31st May 2020

Goods that fall within the measures will be subject to mandatory BMSB treatment BEFORE departure. If arrived untreated or treated by an unapproved treatment provider, cargo will need to be treated onshore or denied discharge and directed for export on arrival.

In response to the rapid expansions of the BMSB throughout Europe and North Amercia, the department has strengthened the seasonal measures to manage risk of BMSB from arriving in Australia for the 2019-20 season to include more countries

Some Countries include:

- Belgium

- Canada

- Czech Republic

- France

- Germany

- Greece

- Italy

- Netherlands

- Spain

- Turkey

- USA

- Japan (heightened vessel surveillance will be the only measure applied)

For a list of all countries please CLICK HERE

The department will be monitoring a number of emerging risk countries (watch list countries) throughout the season. Target high risk and risk goods from these countries may be subject to random onshore inspections to verify freedom of BMSB contamination and if BMSB is detected will be directed for onshore treatment.

For all approved treatment providers offshore please CLICK HERE

For all approved treatment providers onshore please CLICK HERE

For further information on the BMSB season please CLICK HERE

Sideloader Levy ex Sydney

Our trucking carriers have sent out notices for an increase of the sideloader levy ex Sydney Ports.

As of 5/7/19 the sideloader levy will be increased to $75 per container

GENERAL

Origin Waiver Benefit for Australian Trusted Traders

As of 28 June 2019, Australian Trusted Trader importers will no longer be required to obtain or present origin certification documents, such as a Certificate of Origin (CoO) or Declaration of Origin (DoO), in order to claim preferential rates of duty under certain free trade agreements (FTAs).

Trusted Trader imports will still be required to keep evidence (generally for a period of at least 5 years from the day of importation) that imported goods comply with the relevant rules or origin and present this if asked.

For more information about Trusted Traders & this origin waiver benefit please CLICK HERE

Full Article >

AIR FREIGHT

Export Airfreight Security

100% piece level X-Ray screening of all cargo traveling by air from Australia on International flights commences 1st March 2019.

SEA FREIGHT

Infrastructure Levy increase

Following previous notices about infrastructure levies, terminals have advised of another increase as of 1st March 2019.

Please note surcharges will be applied as per below:

SYD/MEL/BNE/FRE/ADL FCL Imports/Exports: AUD160.00 – Applicable to all Import/Export cargo arriving/departing all Terminals (SYD/MEL/BNE/FRE/ADL)

SYD/MEL/BNE/FRE/ADL LCL Imports/Exports: AUD15.50W/M – Applicable to all Import/Export cargo arriving/departing all Terminals (SYD/MEL/BNE/FRE/ADL)

GENERAL

Free Trade Agreement Certificates of Origin

Friendly reminder to clients using FTA/COO’s that correct goods descriptions & HS codes are used on the documents.

Australian Border Force (Customs) has advised that if the goods are on the suppliers invoice it must be also on the FTA/COO also for it to apply.

Full Article >Department of Agriculture (DoA) - Amendment to Imported Foods

Notice to advise importers about the outcome of the remake of the Imported Food Control Order & new record-keeping requirements for traceability under the Imported Food Control Act 1992

Effective 1st October 2019

The only change to the remade Order is the inclusion of a classification for surveillance food at subsection 5(6). The classification of surveillance food is as a result of amendments to the Imported Food Control Act 1992 and the remaking of the Imported Food Control Regulations 2019

For more information, please CLICK HERE

Importers records you keep should also allow food that is imported to be traced through all stages of the food chain (from production to distribution)

Food importers must keep the following information in relation to the food being imported:

- a name or description of the food sufficient to indicate its true nature

- batch or lot identification of the goods

- name of the person, business name, street address and telephone number or email address of the producer of the food

- name of the personal, business name, street address and telephone number or email address of the customers that have received the food

- the date the food was received and the date when it was dispatched to customers

- the volume or quantity of the food involved in each transaction

Records must be kept in a manual or electronic system but must be kept for five years.

For more information, please CLICK HERE

Full Article >GENERAL

Importing from China

For all goods shipped effective immediately that require Treatment, certificates of Treatment will ONLY be acceptable from the following issuing authority:

GACC – General Administration of Customs of the Peoples Republic of China

The entry-exit inspection and quarantine duties of the People’s Republic of China are currently managed by the General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ). From 21 August 2018, these duties will be integrated into the General Administration of Customs of the People’s Republic of China (GACC). As a result, the GACC will start to use new certificates and new stamps.

The scope of the change extends to all government certificates as required by the import conditions, including health, veterinary, fumigation and phytosanitary certificates. The security features associated with Chinese government certificates remain unchanged.

TRUCKING

Sydney FCL Cartage

We have in recent times been fortunate enough for our current transport providers absorbing any tolls applicable in the delivery of FCL cargo in and around Sydney, though with the current rises we now have no choice but to pass these tolls onto our valued clients.

Along with tolls, we have seen another increase in timeslot/Infrastructure at the ports.

This charge will be amended to $100/container for Sydney only.

If you would like clarification on any toll prices/delivery concerns, please give our friendly team a call.

Full Article >AIR FREIGHT

Export Airfreight Security

The Federal Government announced new international export screening requirements will apply from March next year.

How you can best prepare:

Only pre-screened freight will be accepted in consolidated format for bypass at the freight terminal. The Department of Home Affairs have outlined what you'll need to do when sending freight from March 2019:

- For export air cargo to the US there will be no change, as this cargo is already examined at piece-level.

- For export air cargo to destinations other than the US, there will be an increased level of screening required.

- Businesses approved as known consignors (KCs) will be able to use their KC security program for air cargo they export to all international destinations, not just the US.

SEA FREIGHT

Infrastructure Levy Increase

Following previous notices about infrastructure levies, terminals have now increased their fee as of 1st January 2019.

Please note surcharges will be applied as per below:

SYD/MEL/BNE/FRE/ADL FCL Imports/Exports: AUD130.00 – Applicable to all Import/Export cargo arriving/departing all Terminals (SYD/MEL/BNE/FRE/ADL)

SYD/MEL/BNE/FRE/ADL LCL Imports/Exports: AUD14.50W/M – Applicable to all Import/Export cargo arriving/departing all Terminals (SYD/MEL/BNE/FRE/ADL)

Brown Marmorated Stink Bug (BMSB)

With the season still in full force, we have seen 3 Italian treatment providers suspended by Australian Quarantine.

Nuova Cianidrica SRL & Radit SRL & La Spezia Container Terminal (LSCT)

Also a few breakbulk/RORO vessels have been turned away by Quarantine as bugs (including BMSB) we’re found dead and alive on board.

With many onshore treatment facilities still playing catch up it is imperative that treatment, where possible occurs overseas to avoid any detention charges once arrived.

All LCL cargo still to be fumigated at origin.

DAWR have identified emerging risk countries include Austria, Bulgaria, Croatia, Slovakia, Slovenia, Spain, Switzerland, Turkey and Serbia. They are also targeting other countries of BMSB concern and include all remaining European countries, Japan, China, Korea, Canada and Chile. Shipments from these countries may be selected for random onshore inspection.

Some good news, there are some conditions where goods may be exempt from the BMSB requirements:

Goods that are manufactured on or after 1 December 2018 may be exempt from the seasonal measures providing they meet the following requirements:

- The goods are manufactured on or after 1 December 2018

- The goods are classed as new machinery, vehicles, vessels and/or new complex parts and equipment. This includes goods classified under the following tariff chapters only: 82, 84, 85, 86, 87, 88 and 89.

- Evidence can be provided to show that the goods are manufactured on or after 1 December 2018. (Evidence can be in various forms such as a manufacturer’s declaration, commercial invoice)

- A declaration can be provided stating the goods are new, unused and not field tested.

- The goods can be verified they have been manufactured on or after 1 December 2018 (Evidence can be supported by labelling on the goods)

BMSB measures will not apply if all the above conditions can be met.

If you think your goods meet the above criteria please give our Customs Brokers a call so we can confirm for you.

GENERAL

Vietnam Customs

Vietnam customs have implemented a new regulation that states that all Bills of Lading must show the HS Code following the description and consignee’s tax ID. Please ensure we receive this information when submitting your Forwarding Instruction.

If the above information is not included on the Bill of Lading, cargo may face delays.

Machinery Imports

All machinery importing into Australia will require a new and unused declaration.

If you don’t have a blank copy on file please call our friendly customer service or sales team and we will send through.

Full Article >GENERAL

ISPM 15 Wood Packaging Requirements for Export Cargo

Please be advised ISPM 15 Wood Packaging requirements must be adhered to when exporting cargo from Australia.

It is the responsibility of the shipper to ensure that any cargo containing wood and/or wood packaging is in line with the requirement of the country of destination.

Please note: Cargo may be delayed and additional costs incurred at shippers’ expense, if these requirements are not adhered to.

Please Click Here. for further information regarding the ISPM 15 Standard, and information regarding the requirements of each country of destinations

Empty Container De-Hire – Sydney

Extensive ongoing delays are being experienced in the dehire of empty containers in Sydney causing long queues and even longer waiting times.

We have endeavoured to absorb the waiting time costs from carriers, though in the event of extended waiting times from carriers we will have no choice but to pass on these additional costs onto our valued customers.

USA Trucking Shortage

Lack of qualified drivers, current drivers switching to distribution jobs, finances, ELD implementation & new health and safety regulations are the main reasons for USA’s continued trucking shortage.

A report from the American Trucking Associations says more than 70 percent of goods consumed in the U.S. are moved by truck, but the industry needs to hire almost 900,000 more drivers to meet rising demand.

As the challenges continue to mount for truckers, capacity is likely to decrease, which means increase in delays plus rates will continue to rise.

To keep on top of distribution needs, please ensure plenty of notice is given for new shipments to arrange accordingly.

AIR FREIGHT

100% Piece-level International Air Cargo Screening 1 March 2019

In addition to the current screening by the CTO’s on all export cargo destined for USA, the Government has made the decision to expand the current 100% piece level screening of all cargo to all International destinations from 1st March 2019

Department of Home Affairs:

"We are strengthening Australia’s aviation security arrangements to respond to the changing security environment; 100% piece-level examination is being introduced for all outbound international cargo from 1 March 2019"

SEA FREIGHT

Brown Marmoratde Stink Bug (BMSB) 2018-19 season

The Department of Agriculture and Water Resources department have announced new seasonal measures to manage the Brown Marmorated Stink Bug (BMSB)

This will apply for goods shipped on or between 1 September 2018 to 30 April 2019

These seasonal measures apply to certain goods (target high risk & target risk goods) manufactured, or shipped from the target risk countries as sea cargo (FCL/LCL)

Target risk countries

USA, Italy, Germany, France, Russia, Greece, Hungary, Romania, Georgia & Japan

Target high risk goods

- Break bulk, including vehicles, machinery, equipment and parts

- Bricks, tiles, ceramics, steel, stone and cement

- Goods likely to be stored in a manner that provides access for BMSB to overwinter.

Target risk goods

- Chemicals, chemical products, salt, minerals, fertilisers

- Plastics, wadding, tyres

- Wood pulp, printed matter, straw, paper, cardboard.

ALL cargo will require offshore treatment by an approved treatment provider prior to shipping.

If not treated off shore cargo might be subject for re-export at importers expense.

Treatment options include:

- Heat treatmentrs

- Methyl bromide fumigation

- Sulfuryl fluoride fumigation

Approved list of offshore treatment providers – Please Click Here.

Note: If goods are shipped from a supplier in a non risk country, but have been originally manufactured/come from a risk country, the supplier will have to provide a declaration of when the goods were received into their warehouse (Date goods Received) – if they received the goods during the BMSB season (2017-18 or 2018-19) the shipment will have to be treated before export.

Please Click Here to prepare for the 2018-2019 Brown Marmorated Stink Bug (BMSB) risk season.

CUSTOMS

Product Emissions Standards

From July 1st 2018 if you import outdoor equipment (i.e: Tools, mowers, brush cutters, boats etc) with a spark ignition engine you will now require a Certification No. or Exemption No. to import into Australia.

These Certificates can be obtained from the engine manufacturer, so please ensure you check with your supplier before purchasing (they should be aware of this import requirement as we are following suit from USA & Europe)

Note: Engines that arrive that do not have a valid certification or exemption No. will not be permitted entry into Australia and will need to be re-exported back to the supplier at the importers cost

For further information please Click Here & Here

Full Article >GENERAL

GST on low value imported goods

Effective 1st July 2018, consumers in Australia will have to pay GST, on applicable goods with a customs value of AUD1,000 or less (low value goods)

Mandatory revised regulatory changes to China Customs Advance Manifest (CCAM)

Applicable for all cargo shipments involving the China Ports (export/import )from 1st June 2018

The following mandatory customer identifier codes must be provided

House B/L Shipper

Shipper Name, detailed address, contact info, including: Telephone number/email address & Enterprise number (for Australia shippers ABN number)

House B/L Consignee

Consignee Name, details address, contact info, including telephone number/email address & Uniform Social Credit Code (USCC)

Note: If consignee is a private individual a passport number must be provided.

Cargo Description

A general description of the commodities won’t be acceptable. Shipper must show the specific commodity names on the house bill.

For example, Wooden Products will be rejected but Wooden Photo Frames will be accepted.

Non-compliance with these requirements will ensure cargo will be rejected to discharge/load in China Terminal by the Customs authorities & may incur Customs fines and other associated costs.

Mandatory Country of Origin Requirements on food labelling

From 1 July 2018 the Australian Competition and Consumer Commission (ACCC) will be ramping up enforcement of mandatory Country of Origin Requirements on food labelling, including a market surveillance check on 10,000 products.

All importers that offer food for retail in Australia will need to comply.

The Country of Origin Food Labelling Information Standard 2016 first commenced under Australian Consumer Law on 1 July 2016.

The labelling requirements will vary depending on whether the food is a priority or non-priority food or was grown, produced, made or packed in Australia or another country.

Priority foods include meat, seafood, fruits and vegetables, most dairy products (e.g. milk, yoghurt and cheese), breakfast cereal, bread, nuts, honey and non-carbonated fruit juices.

Businesses failing to comply with these new laws face penalties.

For Country of Origin food labelling guidance please Click Here.

SEA FREIGHT

New Packing Declaration – 1st July 2018

As per previous notices, the new packing declaration is now in full affect as of 1st July 2018

Please ensure your suppliers are aware of this new format as DAWR will no longer be accepting the old version

To download the new Packing Declaration templates please Click Here.

Adelaide Infrastructure Levy

Following previous notices about infrastructure levies, Adelaide Container Terminal will now follow suit

Please note surcharges will be applied as per below:

FCL Imports/Exports: AU55.00 – Applicable to all Import/Export cargo arriving/departing all Terminals (SYD/MEL/BNE/PER/ADL)

LCL Imports/Exports: AUD2.50W/M – Applicable to all Import/Export cargo arriving/departing all Terminals (SYD/MEL/BNE/PER/ADL)

Full Article >GENERAL

Department of Agriculture & Water Resources (DAWR) – Important Changes to Packing Declarations

The Department of Agriculture & Water Resources (DAWR) have recently updated the packing declaration again which can be used with immediate effect.

The new packing declaration will officially be required for shipments that have departed from their origin on or after 1st July 2018.

So what’s changed?

DAWR has aligned the Non Commodity Information Requirements policy and the Non Commodity BICON Case with the import conditions for bamboo packaging. Bamboo packaging is now acceptable provided it is treated by an approved method prior to export or on arrival and does not need to be declared as unacceptable packaging.

These new declarations must be in place by 1st July 2018 for all shipments arriving by sea freight or there will be delays in clearance. DAWR WILL NOT accept the old Packing Declaration after the 1st July 2018 & shipments will require unpack inspection at the Importers cost if the old format is used.

Please ensure your suppliers are aware of this new format for your future shipments.

To download the new Packing Declaration templates please Click Here.

Full Article >

CUSTOMER NOTICE

Chinese New Year 2018 – Year of the Dog

Please note Chinese New Year Holiday will begin shortly on the 15th February 2018 through to 21st February 2018.

Most suppliers, trucking companies etc can be on leave for extended periods, so please ensure all documentation required for Customs Clearance and release of your cargo is received prior to the holiday to avoid any delays.

Please see below Chinese New Year holiday season dates. Our origin offices will be operating with skeleton staff over the holiday season.

- China: 15-21 Feb

- Hong Kong: 16-19 Feb

- Singapore: 16-17 Feb

- Malaysia: 16-17 Feb

- Taiwan: 15-20 Feb

- Philippines: 16th Feb

- Thailand: 16th Feb

- Vietnam: 14-20 Feb

- Korea: 15-17 Feb

Leading up to Chinese New Year will see high congestion, as Shipping Lines push through last minute cargo. Appreciate your understanding during this busy period and please don’t hesitate to speak to us if you expect to ship cargo around this period so we can help to minimise any delays where possible.

If you require any further information/clarification, please don’t hesitate to contact our office and speak to our lovely Sales/Customer Service staff: 02 9316 5744

Full Article >GENERAL

Important Notice for Containerised/LCL Imports from Italy – Updated

As per previous notice sent 17/1/18 about the Brown Marmorated Stink Bug (BMSB) season, we have received some updated information – please note below for cargo ex origin Italy.

- If you have multiple lines of cargo from multiple countries BUT are being shipped from a non-Italian port = Container is still subject to the mandatory BMSB treatments, unless we can provide evidence (i.e manufacturer’s declaration) that the lines of Italian origin were not exported from Italy during the BMSB season (between 1 Sept. 2017 to 30 Apr. 2018)

- Containers that have multiple lines from origin Italy but contain a mixture of excluded tariffs and included tariffs e.g. some food items mixed with other cargo (LCL cargo) = Where any lines are of Italian origin, and hit profiles, the container is subject to the mandatory BMSB treatments. The whole container should be held and goods treated within the container to manage risk of cross-contamination. Where excluded tariffs are present in a container, an ‘agreement to treat’ will be sourt from the importer.

- The mandatory onshore BMSB treatment is not required when the goods have a valid offshore BMSB treatment certificate. Treatment certificates from fumigator Ligur are still not be acceptable, and entries presented with these fumigation certificates will require mandatory onshore BMSB treatment.

Department of DAWR has received legal advice that the ‘unacceptable packaging statement’ must only be used under the Biosecurity Act 2015.

For your LCL cargo ex Italy, we will do our best to ensure that we have the containers treated as quickly as possible and have the cargo unpacked and available for you in a timely manner. This will however delay the unpack of the containers.

We will require a completed treatment of authority form for all goods arriving ex Italy to Australia, which will need to be returned no later than 5 days prior to arrival. These will be distributed accordingly from our team as required.

Fumigation cost will be pasesd on at cost from warehouse.

Full Article >GENERAL

Important Notice for Containerised Imports from Italy

As per previous advice about the Brown Marmorated Stink Bug (BMSB) season, we received correspondence from the Department of Agriculture and Water Resources (DAWR) highlighting that there has been a significant number of BMSB detections arriving from Italy. These detections indicate that BMSB are sheltering in a range of containers and goods outside of those captured by existing measures.

To manage the risk posed by these goods, all containerised goods shipped via sea from Italy that arrive in Australia between 17 January and 30 April 2018 will be required to undergo mandatory fumigation or heat treatment onshore.

Exceptions apply to goods treated offshore or that fall within one of the excluded tariff groups as outlined below:

- Fresh produce (including live plants and nursey stock

- Live animals

- Food for human consumption

- Seeds for sowing

Department of DAWR has received legal advice that the ‘unacceptable packaging statement’ must only be used under the Biosecurity Act 2015.

All other containerised goods arriving from Italy, including those already en route to Australia will require treatment on arrival using methyl bromide fumigation, unless already treated offshore. Where methyl bromide is not suitable, another approved treatment for BMSB must be applied on arrival.

When unpacking goods, care should be taken to inspect locations where BMSB may gather, including crevices or protected areas of shipping containers, inside goods or within packaging materials. If the insects are detected importers should notify the department immediately.

GENERAL

Infrastructure Levy – Continued…

Further to previous introduction of the Infrastructure Levy by terminals in Sydney, Melbourne, Brisbane and Perth, we have now received notice of an increase of this fee into all ports. Effective ETA/ETD 1st January 2018.

We have been advised that the Terminals continue to face on the most difficult markets in decades, arising from over-capacity in the local stevedoring market, larger ships and consolidation of Shipping Lines, as well as increased costs – including: rises in property costs, council rates, land tax and engergy costs. With the raised surcharge, the Terminals will continue to improve service levels & invest in lanside equipment and terminal capacity to handle peaks in container volumes.

Unfortunately this additional charge will impact our FCL/LCL pricing, we therefore will need to pass on this cost to our valued customers:

The increased surcharge will be applied as per below:

FCL Imports/Exports: AU55.00 – Applicable to all Import/Export cargo arriving/departing all Terminals (SYD/MEL/BNE/PER)

LCL Imports/Exports: AUD2.50W/M – Applicable to all Import/Export cargo arriving/departing all Terminals (SYD/MEL/BNE/PER)

Further to the Stevedors introducing Infrastructure Levies, the FAK depot/warehouses are now following suit.

Effective ETA/ETD 1st January 2018, this surcharge will impact further to LCL pricing and be applied as per below:

LCL Imports/Exports: AUD10.00W/M – Applicable to all Import/Export cargo arriving/departing(SYD/MEL/BNE/PER)

With the two separate Infrastructure Levies, we will combine in our pricing to offer as per below:LCL Imports/Exports: AUD12.50W/M – Applicable to all Import/Export cargo arriving/departing(SYD/MEL/BNE/PER)

Timber Due Diligence… Full Compliance by 1st January 2018

Australia’s illegal logging laws The Illegal Logging Prohibition Act 2012 (the Act) came into force on 28 November 2012. The Act seeks to ‘reduce the harmful environmental, social and economic impacts of illegal logging by restricting the importation and sale of illegally logged timber products in Australia. The Act makes it a criminal offence to knowingly, recklessly or intentionally import illegally logged timber and/or timber products into Australia.

This Regulation Impact Statement (RIS) addresses the department’s proposals to minimise the cost to businesses and individuals of complying with the Regulation’s due diligence requirements.

With the conclusion of the RIS process, the department will also end its existing ‘soft-start’ compliance period.

From 1 January 2018, Department of Agriculture and Water Resouces (DAWR) will be performing Due Diligence Audits on a random basis and expects ALL Importers of target goods to have completed and be able to show proof that they have done their due diligence.

Businesses and individuals who import regulated timber products into Australia, or who process domestically grown raw logs, may face penalties for failing to comply with the due diligence requirements.

For further information on Illegal Logging/Timber Due Diligence requirements, please Click Here.

Brown Marmorated Stink Bug (BMSB) – Update

As per previous advice about the Brown Marmorated Stink Bug (BMSB) season, The Department of Agriculture and Water Resources (DAWR) has recently discovered significant numbers of BMSB on arrival in Australia in non-target containerised goods arriving from Italy.

These dectections indicate the BMSB are sheltering in a range of containers and goods outside of those captured by the current mandatory measures.

To manage the risk posed by these items, the department will be:

- Inspect a broader range of goods arriving in Australia from Italy not currently being captured

- Increase the total amount of inspections of goods arriving in Australia from Italy

Importers shipping consignments to Australia during the BMSB risk season should ensure their stakeholders are aware of the risk of BMSB infestation and the importance of preventing infestation prior to shipping, while also advising operators to stay vigilant for the presence of these insects when unpacking goods on arrival.

For further information on BMSB updates, please Click Here.

Full Article >GENERAL

Brown Marmorated Stink Bug (BMSB)

Please be advised that the measures for the management of Brown Marmorated Stink Bugs (BMSB) new season will commence 1st September 2017 – 30th April 2018

During this period all high risk commodities, including: vehicles, boats, machinery and machinery parts are required to be fumigated at origin to avoid additional charges & delays upon arrival in Australia.

The measures will apply to target goods not only from USA but also for this season Italy.

For further information & FAQ please Click Here.

Full Article >GENERAL

Infrastructure Levy – Continued

Further to previous introduction of the Infrastructure Levy for Sydney & Melbourne ports by DP World, we have now received notice that Patrick’s will also be implementing this fee into Australia (excluding Adelaide). Effective ETA/ETD 10th July 2017.

We have been advised this surcharge is caused from a rise in property costs, council rates, land tax and terminal maintenance at the Sydney Terminal over recent years.

Unfortunately this additional charge will impact our FCL & LCL pricing, we therefore will need to pass on this cost to our valued customers:

The surcharge will be applied as per below:

- FCL Imports/Exports: AUD25.00 – Applicable to all Import/Export cargo arriving/departing at DP World Terminals (SYD/MEL/BNE/PER)

- FCL Imports/Exports: UD30.00 – Applicable to all Import/Export cargo arriving/departing at Patricks Terminals (SYD/MEL/BNE/PER)

- LCL Imports/Exports: AUD1.50W/M – Applicable to all Import/Export cargo arriving/departing at DP World & Patricks Terminals (SYD/MEL/BNE/PER)

Department of Agriculture & Water Resource (DAWR) – Reminder of Important Changes to Packing Declarations

As you now may be aware, the implementation of the new Packing Declarations is in full affect.

If you haven’t reminded your suppliers, please send the new format which is applicable for all shipments arriving into Australia. For regular shippers it may be a good idea to use the annual Packing Declaration – This will eliminate having to fill out Packing Declarations for each shipment

As referenced in NNF 2016/060 key changes affecting Broker Approved Arrangements we would like to bring to your attention a key change that will affect “Prohibited packaging material statement” since the implementation of the Biosecurity Act 2015, which places restriction on the use of the term ‘prohibited’ in relations to packing material.

‘Prohibited packaging material statement’ as required by the Non commodity information requirements policy has been replaced by the ‘unacceptable packaging statement’.

Department of DAWR has received legal advice that the ‘unacceptable packaging statement’ must only be used under the Biosecurity Act 2015.

These new declarations must be in place by June 10 for all shipments arriving by sea freight or there will be delays in clearance of sea freight cargo. DAWR WILL NOT accept the old Packing Declaration after the 16th of June & shipments will require Unpack Inspection at the Importers cost.

These new declarations must be in place by June 10 for all shipments arriving by sea freight or there will be delays in clearance of sea freight cargo.

To download the new Packing Declaration templates please Click Here.

Full Article >GENERAL

Department of Agriculture & Water Resource (DAWR) – Important Changes to Packing Declarations

As referenced in NNF 2016/060 key changes affecting Broker Approved Arrangements we would like to bring to your attention a key change that will affect “Prohibited packaging material statement” since the implementation of the Biosecurity Act 2015, which places restriction on the use of the term ‘prohibited’ in relations to packing material.

‘Prohibited packaging material statement’ as required by the Non commodity information requirements policy has been replaced by the ‘unacceptable packaging statement’.

Department of DAWR has received legal advice that the ‘unacceptable packaging statement’ must only be used under the Biosecurity Act 2015.

These new declarations must be in place by June 10 for all shipments arriving by sea freight or there will be delays in clearance of sea freight cargo. DAWR WILL NOT accept the old Packing Declaration after the 16th of June & shipments will require Unpack Inspection at the Importers cost.

To download the new Packing Declaration templates please Click Here.

Full Article >OCEAN FREIGHT

New Infrastructure Surcharge at DP World

Starting as of the 17th April 2017, Sydney Ports will introduce an Infrastructure Surcharge Levy on all inbound and outbound FCL containers.

We have been advised this surcharge is caused from a rise in property costs, council rates, land tax and terminal maintenance at the Sydney Terminal over recent years.

We will pass this surcharge on at cost of AUD25.00 per container. This will apply to all FCL containers received or delivered via road or rail to Sydney Port.

Another Shipping Line Acquisition

Maersk Line and the Oetker Group (Hamburg Süd) have reached an agreement for Maersk Line to acquire Hamburg Süd. The acquisition is subject to final agreement and regulatory approvals.

Hamburg Süd is one of the world’s largest container shipping lines and a leader in the North-South trades. They have 130 container vessels with container capacity of 625,000 TEU (twenty foot equivalent), and over 250 offices across the globe.

Over the last year, there have been many changes with Shipping Line’s including, acquisitions, mergers and Hanjin Shipping declaring Bankruptcy. We will update you as further developments transpire.

AUSTRALIAN BORDER FORCE

Asbestos in Imported Vehicles – Customs Alert

Last week, Australian Border Force (ABF) has updated their requirements for vehicles being imported into Australia. Any used vehicle imported into Australia must be free of asbestos. ABF are now heavily enforcing this policy.

Importers will now need to declare their vehicle/s of import do not contain any asbestos before receiving ABF clearance.

Vehicle parts that ABF are most concerned about include: Clutch linings, brake linings, brake pads, seals, head gaskets & transmission components.

As the Importer, it is your responsibility to ensure your vehicle/s does not contain asbestos. If you are unsure please enquire with your supplier.

Additional documents now required will be an asbestos declaration, detailing vehicle/parts are asbestos free to provide ABF as supporting evidence. More information can be found by clicking here.

AIR FREIGHT

US Air Cargo Security Implementation

Implementation of US air cargo security will commence as of the 1st July 2017. All US bound air cargo from Australia will be required to undergo a screening and examination process to be allowed entry into the US.

The new X-Ray system for screening will be available upon this date. A screening process fee will apply.

The Known Shipper Scheme offers exporters an alternative way to meet US air cargo security requirements.

More information can be found by clicking here.

Full Article >GENERAL

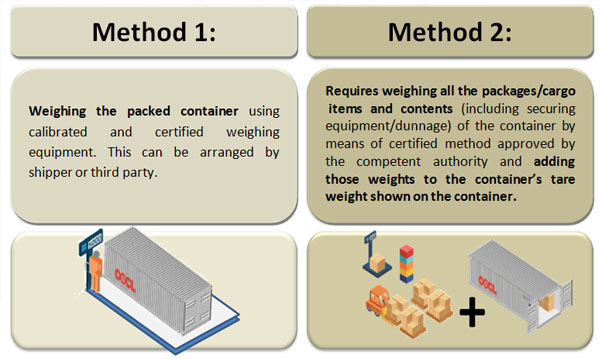

New Solas VGM requirement for Australia

Effective 1 July 2016, shipper of all export packed containers will be responsible for determining and declaring the verified gross mass (VGM) per container prior to collection and lodgment as a condition of loading aboard a vessel.

The shipper or person named on the bill of lading, is responsible for determining, documenting and submitting the VGM of a packed container to the contractual carrier. If a third-party is entrusted with weighing a container and submitting the data on the shipper’s behalf, the shipper still remains fully responsible (liable) for the accuracy of the VGM.

How do I calculate the VGM?

Shippers may use one of two methods to determine the VGM:

- Method 1 - Weighing the fully loaded container after it has been packed.

- Method 2 - Weighing the contents of the container, including cargo and any packing materials, and then adding that to the tare weight of the container printed on the door.

NOTE: Estimating weight is not permitted.

How should I submit the VGM to Control Global Logistics?

As the shipper, you will need to complete and submit your container VGM data to Control Global Logistics with a VGM Declaration form.

The VGM Declaration must be received prior collection of packed containers.

For further information or inquiries please speak to our team.

Full Article >GENERAL

Chinese New Year 2016 - Year of the Fire Monkey

Gong xi fa cai! (Or Kung hei fat choy! if you're speaking Cantonese.) welcome, the year of the fire monkey. Please note the below Chinese New Year holiday season country reference dates. Our origin offices will be operating with skeleton staff over the holiday season.

| Country | Dates close | Resume work |

| China | Feb 7-13 | Feb 14 |

| Hong Kong | Feb 8-10 | Feb 11 |

| Indonesia | Feb 8 | Feb 9 |

| Malaysia | Feb 6-9 | Feb 10 |

| Singapore | Feb 8-9 | Feb 10 |

| Taiwan | Feb 8-12 | Feb 15 |

CHAFTA - China Australian Free Trade Agreement

The new China Australia free trade agreement has taken effect as of 20th December 2015.

Claiming CHAFTA, will be subject to the importer being able to provide a “certificate of origin / free trade agreement” at time of importation. This certificate can be obtained from the below authorities.

- AQSIQ (General Administration of Quality Supervision, Inspection and Quarantine) where the actual certificates will be issued by provincial Entry-Exit Inspection and Quarantine Bureaus, which are administered by AQSIQ; and

- CCPIT (China Council for the Promotion of International Trade)

Conversely, for Suppliers exporting to China the below export bodies will produce required certificate of origin:

- The Australian Chamber of Commerce and Industry

- The Australian Industry Group and affiliated bodies and

- The Australian Grape and Wine Authority.

AIR FREIGHT

Singapore Airlines launches Capital Express route

Singapore Airlines reported new services flying to and from Canberra. Aviation experts say Singapore Airlines would be the most logical airline to step into the Canberra market.

The company may soon operate direct flights from Canberra to Singapore with a connecting flight to Wellington. With a possible Four weekly flights using an Airbus A330 would run between Singapore and Canberra, with the same service used to run a return flight between Canberra and Wellington.

WAREHOUSING & DISTRIBUTION

3PL – Third Party Logistics

The increased need for business outsourcing logistic operations, in order to emphasize on their main business operations is a key factor for driving the growth and need for third party logistics (3PL) globally. The growth of online retailing, off-shore manufacturing and increase demand in faster delivery and turn around time delivery and emergence of industry specific logistic services is also driving this growth of the global market.

3PL services range from a simple unpack and storage solution to pick & pack and distribution throughout Australia and the world.

Can 3PL assist?

Affordable warehousing costs, inventory reporting and knowledge of exactly what product items are available at your finger tips. High grade facilities and system solutions. Pick and pack, local or world wide freight distribution. Storage and handling of all items from perishables to heavy machinery and parts. Notification Alerts when stock items are low. Express delivery to your clientele with fast turn around time from order to final delivery and much more.

Our customized services can cater for your business needs to work with you to provide the solution to cater for all your warehousing and distribution needs.

We offer a simple and affordable solution, reducing you’re cost and increasing your resources.

Please contact our team to go over any requirements and see where we can help your business today.

Full Article >AUSTRALIAN CUSTOMS

Upcoming Customs and Border Protection Strikes

Australian Customs and Boarder Protection will be holding further strikes that will include 24 hour bans impacting on National Container Examination Facility (CEF) operations.

Customs usual procedure is to process approximately 100 containers per day. Most containers are x-rayed, risk assessed and returned to the terminal for delivery with minimal delay.

Potential strike action will take effect early November. Containers selected for border processing will remain on hold until the CEF can process these containers; regardless if the containers go into storage or detention.

Areas were we can limit the pain are for importers to ensure that all commercial documents are handed over at least 4-5 days (when possible) before the vessel arrives, to ensure that the customs declaration is lodged to allow sufficient time to be processed by authorities.

OCEAN FREIGHT

Another Carrier Pulls the Pin

NYK Line has announced that their container trade will no longer service Australia. NYK will withdraw from the Asia-Australia by mid-2016, a move likely to trigger a significant reorganisation of consortia and services. This will not effect their breakbulk / RORO PCC services.

Peak Season

As we are now in peak season leading up to both Christmas and the New Year, carriers are announcing General Rate Increases.

Currently the FCL rates are in a fortnightly cycle where rates are changing mid and end of each month. Certainly this year does not have the same Peak Season Surcharges that we have seen in previous years though carriers are desperately trying to increase freight amounts whilst space is at a premium.

We are seeing general rate increases (GRI) applied to most carriers from China, South East Asia and USA. These increases range from USD 250 / USD 500 and expecting a further planned GRI to apply by all carriers as of the 15th November.

Marine Insurance

Needing Marine Insurance cover for your shipment?

Needing best Insurance options at the lowest prices? we have the answer. Have Control Global Logistics to cover your shipments at the best pricing that cover not only your cargo value but the shipment cost also. Speak to our Team for further information and rates.

Full Article >OCEAN FREIGHT

General Rate Increase (GRI)

Ocean Carriers operating from North East Asia to Australia have announced a possible GRI of USD300/20’ and USD600/40’ effective 15 May 2015.

Ocean Carriers operating from USA to Australia have announced a possible GRI of USD175/20’ and USD350/40’ effective 15 June 2015.

Even though a number of Ocean Carriers have made these announcements, we will be closely monitoring the situation and ONLY on-charge whatever increases are implemented by them.

USA Rate Reduction

Ocean Carriers operating from USA to Australia have announced the BAF (Bunker Adjustment Factor) will be reduced to USD463/20’ and USD926/40’ with most carreirs effective 15 June 2015.

Container Damages

We are noticing that a number of Ocean Carriers are increasing their inspections of damage to returned containers. Please note, damage to containers occurred during hire is the responsibility of the consignee. Please ensure that your suppliers inspect the containers prior to loading, ensuring they are free of damage, so as to minimise problems upon receival.

Vessel Delays

As a flow on effect from our recent east coast inclement weather, vessels were delayed calling into Sydney. Many Ocean Carriers redirected their vessels to call into other ports first, and as such, we are seeing some vessels delayed now for up to 7 days. For more information, please contact our Customer Service Team.

Maersk Tigris's seizure news

In the last month the Maersk Tigris, a Marshall-Islands flagged container ship and its crew were seized and held in Bandar Abbas port of Iran.

The vessel was diverted on 28 April by Iranian patrol boats in the Strait of Hormuz, prompting the United States to send vessels to monitor the situation and to accompany U.S.-flagged vessels passing through the Strait.

Iran had said the vessel would be allowed to continue, once a years-old debt case with the vessel’s charterer, Maersk Line was settled.

In a statement released by the operator and manager, "Rickmers Group is pleased to report today its managed container vessel Maersk Tigris with 24 crew members on board has been officially released by Iranian authorities following an order from the court in Bandar Abbas, Iran.”